The curious case of the local hardware store with lower prices than Amazon

Americans love Amazon, and have demonstrated this affection with their wallets, making the Seattle-based online superstore extremely profitable. Each year, in fact, Amazon gets bigger relative to other online retailers, as consumers award it a larger share of their total online shopping budget.

This means that each year, Amazon amasses a little more power, and becomes a little more entrenched in its seat atop the online retail hierarchy. A cynic might note that each year, said entrenchment means Amazon is a little more likely to abuse this power at the expense of its customers.

We may have already reached that tipping point. Amazon’s customers are arguably its most valuable asset, of course. So far, these customers have been extremely loyal to the Seattle retailer. Amazon Prime certainly plays a role in this, of course. Such loyalty wouldn’t be possible if its customers didn’t believe Amazon was a benevolent monarch. But is it really? People may know how ruthless the company can be by the way it dispatched competitors, decimating the bookstore industry. What would happen if consumers knew Amazon was now pointing that gun in their direction, and has been for some time now?

Amazon’s goal is clear: to take more money from our wallets every year, and have us thank them for doing so.

Amazon’s Power Trip

Amazon’s pricing practices are legendary and predatory, but not in an obvious way most of us are attuned to. The company subtly manipulates prices in such a way that people don’t notice. Sometimes the price gouging isn’t subtle, however, such as when the company raised the Amazon Prime annual membership fee by $20 in 2018. This increase translates to $2 billion more in Amazon’s pocket every year.

This is pure greed at play. A $2.00–$5.00 Prime increase would have covered any increased costs associated with administering that program, but Amazon hiked the price by $20 for one reason: it could. Prime members are, in many ways, a captive audience, unable to pivot to a different store without experiencing the sunk cost fallacy that makes them regret such a decision. It’s called a fallacy for a reason. It’s one of many ways humans miscalculate risk and reward, a weakness Amazon has become an expert at exploiting.

Consumer backlash against Amazon over the Prime increase was minimal to nonexistent. Wall Street, on the other hand, applauded it. Consumers don’t just love Amazon, they love loving it. So they look the other way when evidence regarding less than impeccable behavior surfaces. And lately it has surfaced quite a bit.

Questioning Amazon’s Low Prices

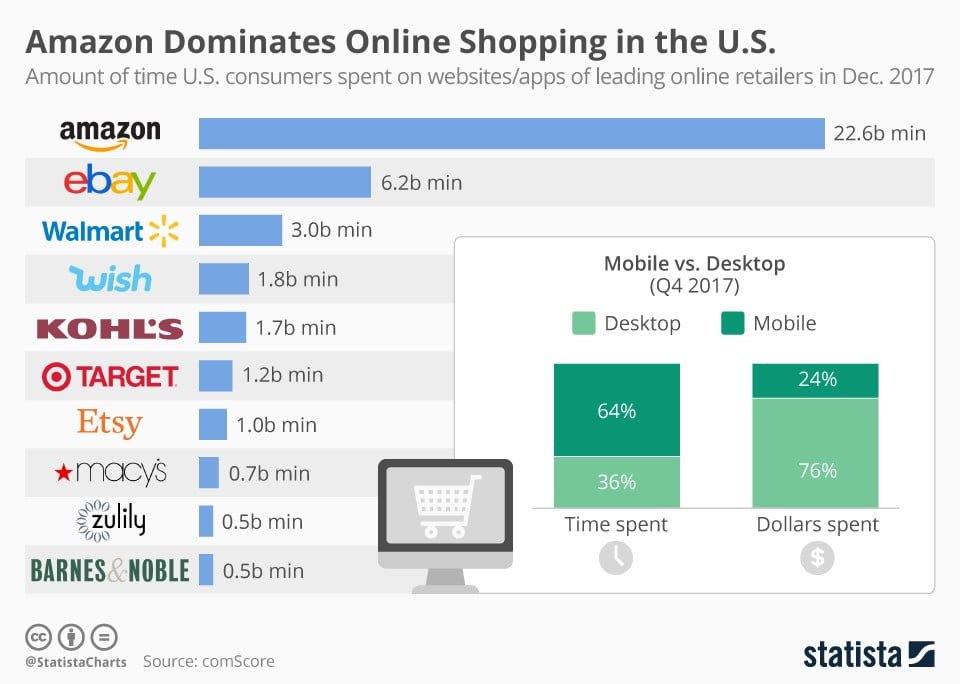

Americans have great love for Amazon. The Seattle company’s market share is five times greater than the number two online retailer, Walmart. There are many reasons people shop at Amazon, but the store’s “low prices” is one of the biggest. Most U.S. shoppers believe Amazon’s prices are among the lowest. a big reason many consumers keep coming back. Most U.S. Amazon shoppers believe Amazon’s prices are lower than any other retailer’s. And I believe it can be argued that Amazon’s low prices are from where consumers’ esteem originates. Without its trademark low prices, two-thirds of Amazon’s customers report that they would no longer be compelled to shop there again, according to data from Statista.

Here’s the thing though: most of Amazon’s so-called lower prices have evaporated already— or perhaps never existed at all. Consumers haven’t quite woken up to that fact yet, however, and that’s largely because the means by which Amazon has been replacing its trademark low prices with high ones is also incredibly good at obfuscating the price increases. It’s a strange psychology theory called price perception, and it’s discussed in some detail in my companion story about it.

I once had the same misconception about Amazon’s prices most U.S consumers have today, believing them to be lower than they are. In fact, other than grocery shopping, I attempted whenever possible to buy what I needed from Amazon, strongly believing that this was a financially responsible decision.

This idea was at least in part due to my awareness of the new economy rules regarding the advantage online retailers have over traditional (brick-and-mortar) retailers — namely, that increased costs associated with operating stores put traditional retail at a disadvantage compared to online retails, who can keep prices down since costs are lower.

Then a trip to my local hardware store turned the above rule on its head.

Ace Hardware vs. Amazon

It was with some trepidation that I found myself entering a hardware store in March of this year. I didn’t set foot in stores like that, as a rule. Yet I had no choice, since I had been tasked with copying a house key, and as far as I knew it there was still no online service with which to do that. (Hardware stores, in fact, with all of the mixing, measuring, and cutting associated with sales of its merchandise, might actually be “online-proof” now that I think of it.)

Online-proof or not, I was quite certain that any product I bought at my local Ace Hardware store, a cooperative called Logan Hardware — located on a trendy stretch of revitalized 14th Street in northwest Washington, D.C. — could be purchased for less at Amazon. My confidence in Amazon’s ability to undercut Logan Hardware was high, especially with evidence that the costs of running Logan Hardware’s 10,000 square foot store must be astronomical.

Thus, I promised myself not to impulsively buy anything. “Stick to the plan, just copy the key,” I told myself. Nevertheless, an hour later, I exited Logan Hardware with a bag containing about $20 worth of home improvement merchandise. Nothing was especially urgently needed, so I was pissed at myself for my lack of restraint and patience.

I knew I could have saved a lot of money buying those same items from Amazon, so I decided to find out just how much. I created a rudimentary spreadsheet to capture that data (see below), and filled in the Logan Hardware figures.

Knowing that the results would show Amazon’s prices were lower, I drafted in my head an article for Medium about consumers’ changing shopping preferences as online retail expands and traditional retail contracts. It would estimate how much the average consumer might be saving today by shopping at Amazon instead of at local brick-and-mortar shops. It would end with a warning about how neglecting our local retail industry — stores in mixed-use, walkable neighborhoods — might change the fabric of our cities for the worse. All in service of Amazon, and to save a few bucks.

But that’s not the article I wrote. Because that’s not what the data showed. Not even close:

It wasn’t supposed to be possible, but the brick-and-mortar Ace Hardware cooperative known as Logan Hardware undercut Amazon by a big margin. It was just a dollar or two per item, but those dollars added up.

For the basket of products I purchased, all low-cost, small-ticket items, Ace Hardware’s prices were on average 35% lower than Amazon’s.

The small-price-tag status of the merchandise was probably a factor in the results (small ticket items are prohibitively expensive to ship to an end consumer in small quantities). Still, the 35% average price differential seemed significant.

I did some digging and learned that Amazon’s higher prices in this instance weren’t an anomaly. Amazon’s pricing strategy ensures this discrepancy, maximizing Amazon’s profits. Its margins are so razor thin in the online retail part of the companh that this profit-maximizing task is useful, but ill conceived in the way it misleads Amazon’s customers, and the potential fallout that could create.

The Ace Hardware Difference

What of Logan Hardware? What part does it play in this case study that contradicts much of what is learned in business school?

There’s no evidence Logan Hardware (or parent company Ace Hardware) intended to undercut Amazon. If so, they certainly marketed it poorly. Logan Hardware’s low prices appear rather run-of-the-mill, actually. And those prices are possible given Ace’s network of hardware stores with collected bargaining.

Further research shows Ace Hardware isn’t the only brick-and-mortar store with Amazon-crushing low prices. Groceries are routinely cheaper at your local grocery chain than at Amazon.

We could examine the rule about property costs and the relative advantage online retail has over traditional retail by not having them. Perhaps modification of it is needed. But I doubt there’s anything wrong with it. The effects of that rule are probably marginal with respect to a well-functioning retail store, and as stated, only operate at all if the online retailer in question wants to compete at all.

My theory is that Amazon, having gained so much market share, is essentially unbeatable at this point in time. Its awareness of this fact has led to the current series of price increases that can almost be interpreted as invitations to spar, or just a middle finger to its customers, who may not have any recourse to correct the super-retailer’s course.

Back to Logan Hardware. I’m confident there are many traditional retailed stores that also have lower prices fans than If there’s one thing this important case study taught me, it’s that it would be a mistake to count traditional retail out yet, and it’s a great time shop local.

Comments are closed.